With the rising cost of land, seed and chemical, crop insurance is becoming more essential for every farmer. In this post you’ll learn what crop insurance is, how it came about and how it helps farmers when crops are damaged.

The reason for the creation of crop insurance is so in the event of a natural disaster like a drought then it isn’t catastrophic for the farmer. They won’t go under, or out of business, due to one bad or even several bad years. Crop insurance basically protects the loss of crops due to a natural disaster. It is regulated by the federal government as it is government subsidized. To be able to write or produce a crop insurance policy, it must be authorized by the US Department of Agriculture. Though the Farm Bill is what strengthens crop insurance.

Being as it is through the government, crop insurance pricing is the same across the board. Within the Department of Agriculture, there is the Risk Management Agency (Also known as RMA). RMA sets the rates that will be charged for a policy and determines which crops can be insured in different parts of the country. Though it is sold and serviced with insurance companies specializing in crop insurance.

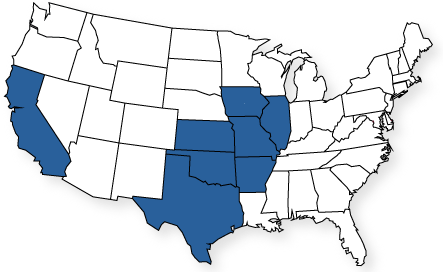

We write our policies through our company, NAU (formerly known as QBE NAU). All crop types might not be available in every state as companies tend to be geared towards crops grown in the area. For example, corn and soybeans are very common in the Midwest but nut tree groves are not very common in the Midwest. Corn and soybeans are not as common in southwestern states. This is because the purpose of insurance is to be a large pool for similar coverages.

There are several parts of crop insurance, but we will focus on two major components of crop insurance which are MPCI, or Multiple Peril Crop Insurance, and hail insurance.

MPCI covers the natural losses or events caused by nature that either created a total loss or lowered yield. These events would include weather (such as frost, wind and hail), disease, drought, fire, flood or insect damage. Multiple peril crop insurance must be bought every year to keep the policy and deadlines are set by the federal government. If the policy is not paid, it cannot be bought again for the next year. If the policy is not bought and paperwork signed in the next year, then there will be no coverage for the crops. There are two types of coverages within MPCI and many other policies for crop insurance which is Yield Protection and Revenue Protection. They protect against low yield and protection for the revenue so there is protection for a low yield and protection for the revenue that would have been made during that bad year. Keeping farmers in business is the whole goal of crop insurance, if there are problems with their harvest and even planting. There is also coverage to replant if a drought or heavy rains kill your crop early in the season, the coverage is Replant. With NAU, there is even a separate policy, sold by NAU, to give extra coverage for replanting your crops.

Hail insurance is provided within the MPCI policy, but it can also be bought through private insurance and is not government regulated. This is typically an enhancement separate policy. This policy is usually very popular as it can cover loss in only one part of the field instead of with MPCI, which would need the whole field to be destroyed. As hail is typically very fickle and will strike only certain areas. It also can pop up very quickly. This is why with NAU, you are able to have a hail policy written two hours before a hail storm with no firm deadlines on creating the policy. Many companies also have a low or no deductible for crop-hail insurance. It helps keep your APH at the rate it should be in the event of a hail storm.

If you have anymore questions about specialized perils or other policies offered like Pasture, Range Land and Forage or Whole Farm please contact us today and we will be happy to help you with any Crop Insurance questions!

Disclaimer

This article does not reflect the thoughts, views and opinions of NAU, the anything expressed in the text belong solely to the author. All views expressed on this article are my own and do not represent the opinions of any entity whatsoever with which I have been, am now or will be affiliated.

NAU is an equal opportunity employer and does not discriminate on the basis of race, color, religion, sex(including pregnancy and gender identity), national origin, political affiliation, sexual orientation, marital status, disability, genetic information, age, membership in an employee organization, retaliation, parental status, military service, or other non-merit factor.