If your business does any work on or near railroad tracks, then you are probably familiar with the term Railroad Protective Liability or RPL. It is something that is requested 9 times out of 10 but more like 10 out of 10 times because you’ll find it required if you are doing any of this […]

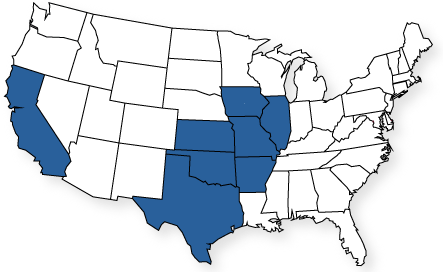

Risk Management, Commercial Insurance and Mid America Specialty Markets

I know what you are probably thinking, “Risk Management? What is that? And why do they say they specialize in it? Aren’t they just your run of the mill insurance agents?” Well, you may be right, but Risk Manager has a nice ring to it don’t you think! No, in all reality, there is a […]

Longshore and Harbors Act: What is it and Why do we have it?

A long time ago when sea faring workers were injured or killed in their job, there was no compensation for their dangerous work which meant that their families would have no income. This left a huge gap to help protect workers and their families. As technology was advancing, the dangers were changing. Although maritime work […]

A Data Breach Can Ruin Your Business – Are You Really Prepared?

One in five businesses have suffered a data breach or cyber attack and if you ask most business owners they will tell you they are prepared! Really?? Think about that. Twenty percent of all businesses have suffered a loss of their clients personal and private information.Let’s talk about how a data breach can ruin your […]

House of Worship – Insurance Coverage for Your Church

Your faith and congregation are important to you and that’s why protecting them from loss is so important to us. We know how amazing the architecture that goes with many churches no matter how small or large. From the stained-glass windows of the church sanctuary to the kitchen and gathering rooms, from solid limestone exteriors […]

Support Small Business Saturday in Your Community!

Tired of the huge crowds at all the big box stores? Well today, November 24, 2018 is Support Small Business Saturday. It’s the day after Black Friday and it’s a day that is so important to your local small business community. I’m sure that in your home town you have a very active local small […]

Do I Need an Independent Agent or Buy My Insurance Online?

I’m sure you know the old adage that goes “A lawyer who represents himself has a fool for a client.” But have you ever thought that may apply to you? You may find that if you follow today’s trend and buy your insurance from an online insurance company, at some point in the future, you may be […]

Crop Insurance – Who, How, What and Why

With the rising cost of land, seed and chemical, crop insurance is becoming more essential for every farmer. In this post you’ll learn what crop insurance is, how it came about and how it helps farmers when crops are damaged. The reason for the creation of crop insurance is so in the event of a […]

Snow and Ice Removal – Don’t Get Plowed Under!

When driving to work this morning, I heard on the radio that we are expected to get our first snow fall of the year. Prior to doing insurance, I loved the snow. I loved seeing my children build snowmen and make beautiful snow angels. One of my favorites is seeing excitement on their faces when […]

Full Coverage Car Insurance in Missouri – Do You Have It?

When looking for car insurance, many consumers say they want “full coverage.” But, what does full coverage mean? Is full coverage having comprehensive and collision coverage to satisfy the requirement for your lienholder? Is full coverage having liability limits that meet state law? Is full coverage protection against anything that could happen to your car? […]