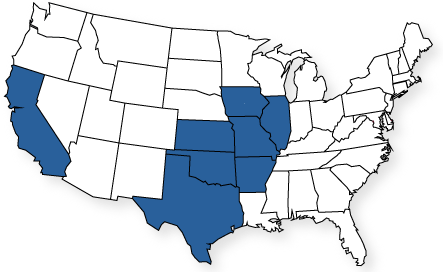

Need Equipment Dealers Insurance in Missouri, Kansas and the surrounding area?

Not exactly an easy class of commercial insurance, you’ll find insurance for Equipment Dealers Insurance requires knowledge and experience to deliver the right type of insurance coverage for your Equipment and Implement Dealership. If you’ve ever tried to quote out your equipment dealers business insurance we’re pretty sure you would have been told that there are only a few, select insurance companies out there who you can get insurance for Equipment Dealers through. That’s not exactly true and that’s why you should check with us! Our special insurance programs include Insurance for Equipment Dealers!

At Mid America Specialty Markets we offer a selection of nationally recognized insurance carriers who have developed and maintain special insurance coverage for equipment dealerships which include Farm Equipment Dealers, Construction Equipment Dealers and Excavation Equipment Dealers. Coverage for your inventory held for sale, building, business personal property, contents, parts department, repair department, loss of income, general liability, product liability, cyber liability and employment practices liability to mention a few.

On this page of our website we will discuss in detail some of the insurance coverages you need when operating an equipment dealership and how you can contact us or buy Equipment Dealers Insurance from Mid America Specialty Markets. If you have any questions about what type of coverage you may need or would like a risk management review or your current insurance program just give us a call! And remember, when you need a quote on your Equipment Dealers insurance be sure to reach out to one of our commercial team members or contact one of our local offices in your area to discuss your specific insurance needs.

Who Needs Equipment Dealers Insurance?

If you are in the business of selling equipment, you do! These insurance programs are specifically designed to provide insurance coverage for:

- Farm Equipment Dealers

- Farm Implement Dealers

- Commercial Equipment Dealers

- Excavation Equipment Dealers

While most of those business owners that operate an Equipment Dealership the standard commercial insurance coverage package will only touch on the basic coverage needed to operate their business. Equipment Dealerships have different loss exposures that other commercial business operations. Those exposures to loss must be properly identified and addressed in order to have the Equipment Dealers insurance coverage respond correctly to a claim situation. We can help you identify those exposures to loss. Just give us a call and get us on your insurance team. You may be surprised how we can help!

Liability Coverage for your Equipment Dealership

Liability coverage can mean different things to different folks. Most of the time when someone mentions liability insurance they are referring to coverage for premises and operations. Specifically this coverage provides protection to your business when someone falls and is injured or otherwise hurt or suffers property damage on your premises or from your normal business operations.

Picture this, you have a customer who falls or stumbles over a display while in your store and breaks a hip. You’ve just incurred a bodily injury claim on your premises and your general liability policy would respond. But what happens if one of your customers is injured by a piece of equipment that you sold them? Do you know if your general liability policy would respond to this type of claim? Would you need some other kind of special liability coverage? Maybe you would need products liability coverage. Do you know if your current insurance policy includes products liability coverage?

Our Equipment Dealers insurance policies included Commercial General Liability to protect your business from a variety of liability exposures including premises and operations and products and completed operations!

Equipment Dealership Policy Components

Multiple “components” make up an Equipment Dealers Insurance policy. Coverage options can be confusing. Some insurance companies will bundle basic coverage while others will allow you to pick and chose the coverage you really need for your specific business. Let’s take a look at some of the variety of policy components that are available for your business.

General Liability Insurance

As we mentioned above, this coverage will protect equipment dealers from bodily injury and property damage and personal injury that some one suffers because of something you may have done or a product you may have sold. This is an essential policy coverage that protects you from negligent acts on your part.

Workers Compensation Coverage

A required coverage in most states. Workers Compensation insurance can be one of the most expensive coverage parts for a business. Proper management of your workers compensation program is a must if you are going to control your insurance related expenses. A business who suffers multiple workers compensation claims will compound the cost by incurring higher, and in some cases, out of control experience modification rates. If you do not understand how uncontrolled workers comp claims can ruin your business you need to talk with one of our commercial team members as soon as possible!

Workers compensation is not just about finding the cheapest rates out there. It’s about finding a knowledgeable, experienced independent insurance agency who understands the critical role this seemingly simple insurance coverage plays in your daily business operations! Contact our office for help with your workers compensation program.

Loss of Income Insurance

When a business suffers a significant property loss and find themselves closed for a period of time they will suffer a serious loss of income. Loss of income is an insurable coverage. As a matter of fact, business interruption or loss of income can be one of the most important insurance coverages you have!

There is no doubt that you must have proper business interruption or loss of income coverage. This coverage will help you to stay in business, pay your bills and even keep some key people on the payroll while your building is being repaired and you get back up and operating. It may be the difference between closing forever or staying in business. It’s that simple.

Property Insurance

Property coverage for equipment dealers insurance provides protection to your building, business personal property, contents, inventory and equipment. It typically protects you from loss due to fire, wind, tornado, hail, storm damage, vandalism, theft along with other more specific coverage. Property insurance is written on basic, broad or special causes of loss coverage forms. Most policies are based on replacement cost so that you would be able to repair or replace the damage at today’s cost.

It’s important to have your building and contents values properly insured at limits that meet your insurance policy conditions.

Crime Coverage

This is a broad coverage category. Basic crime coverage may be included in your business insurance package for theft of business personal property or inventory items. Additional coverage of employee theft may be added to your coverage package.

Cargo Coverage

If you ship or make arrangements for delivery of sold equipment to your clients or customers you may need cargo coverage to protect the value of the item being delivered. Often times those delivery services who you ship your sold equipment with may have independent cargo coverage. But this is something you must be sure is in place to protect your interests. When a piece of equipment valued at $100,000 or more may be on the line you need to have your ducks in line and proper coverage in place. Be sure to check with Mid America Specialty Markets to secure proper cargo coverage for your equipment dealership!

Business or Commercial Auto Coverage

If your business owns trucks or vehicles, you need to have business auto coverage. This coverage will protect you from accidents caused by your business auto. It will also provide you coverage for damage to your specifically insured trucks, vehicles and trailers. If you deliver your sold equipment to your clients you need to make sure you have the correct coverage on your commercial auto package. Liability, Uninsured and Underinsured Motorists, Medical Payments and Comprehensive and Collision are the basic commercial auto coverage you need for your business. A complete equipment dealers insurance program will include commercial auto coverage. We can help you make the decisions on how best to cover your business auto exposures.

Additional Coverage Options

- Errors & Omissions Coverage Package –

- Security Interest E & O

- Truth in Lending E & O

- Odometer and Prior Damage Disclosure Statutes E & O Defense Coverage

- Broad Form Products & Completed Operations – Mechanics Errors and Omissions Coverage

- Personal Injury Extension

- Drive Other Cars Coverage

- Equipment Rental Coverage

- Dealers Blanket Coverage – Coverage for the vehicles you own, such as the ones held on the lot for sale by your dealership.

- Dealers Blanket Coverage Package

- Road Trouble Service

- Reporting Form Available

- Multiple Deductible Options

- False Pretense Coverage

- Garagekeepers – Provides physical damage coverage to items that are in your care, like customers equipment and machinery that is in your shop for repair.

Our Local Locations Where You Can Buy Insurance for Equipment Dealers

- Columbia, Missouri

- O’Fallon, Missouri

- Springfield, Missouri

- Lee’s Summit, Missouri

- Shawnee – Overland Park, Kansas

- Seneca, Missouri

- Clever, Missouri

- Neosho, Missouri

- Lamar, Missouri

- Carthage, Missouri

- On-Line – Commercial Team

How to get started

The process of getting a Restaurant Insurance quote is simple. You can either call us directly, or click over to our Quotes page to give us a little more information about your situation and needs.

Either way, we’ll make the process as easy as possible!